Money anxiety can affect anyone, regardless of your income or wealth, with one in five adults in the UK highlighting money as a major contributor to anxiety. Add into the mixture the current global pandemic hitting the UK, and it’s no surprise that millions of people are feeling the weight of money stress spiral out of control. Whilst the overall situation is still unfolding, here are some practical ways you can get a hold on any financial anxiety you’re feeling right now.

Take control where you can

Anxiety is particularly high when we feel uncertain about the outcome of a situation, so it isn’t a surprise that current anxiety levels are particularly high. This, however, isn’t a free pass to let yourself spiral into an anxiety hole. What it does mean is that taking control of the areas of your life that you can control can help alleviate the feeling of panic that comes with anxiety. When it comes to money, look at the areas you are in charge of where you can make shifts.

- Sit down with your bank statement and audit all of your expenses to see where you can spend less

- Rather than resorting to Deliveroo stress eating, head to the supermarket early and buy fresh food at a fraction of takeaway costs

- If you pay for gym membership, ask your gym provider if it’s possible to freeze your account for the foreseeable future

- If you’re a homeowner, the government has announced that you can request a mortgage holiday from your lender

- Cancel your travel payment if you pay on direct debit or standing order for your monthly commute

Avoid comparison

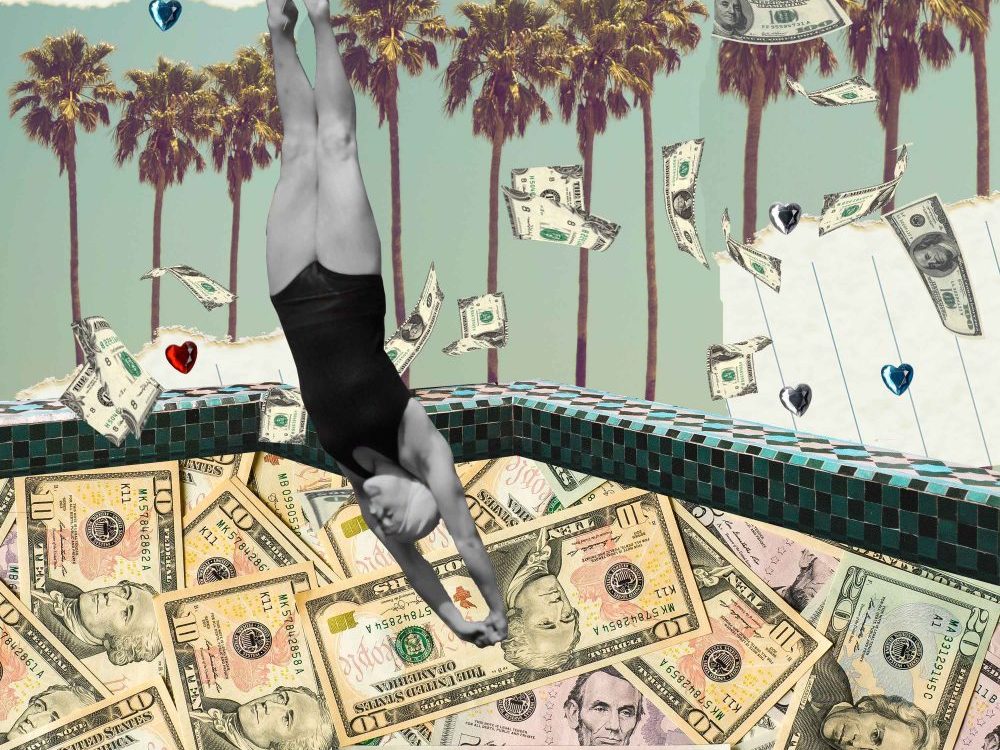

When it comes to money, comparison is never far away from clouding our thoughts and our attitudes. Particularly in a time where we’re spending more time indoors and online, slipping into a comparison trap can be easy. One helpful way to reduce anxiety is removing yourself from environments which provoke comparison, such as social media. Constantly being fed images of people looking beautiful, lounging in their mansions and exercising in their private pools can increase the urge to spend money or conversely, fuel feelings of financial inadequacy and failure. Stay in your own lane – try cleansing your social feeds to ensure you only see content which makes you feel good.

Stop self-shaming

In order to move forward and improve your relationship with money, you have to let go of the mistakes you have made in the past and stop labelling yourself as ‘bad with money’. Negative feelings around money can feed anxiety when it comes to making financial decisions, often getting in the way of making important changes if, for example, we doubt our own judgement

or decision-making capacity. Acknowledge that you may have made errors along the way, but move forward with determination to get your finances on track. Remember that we’re all human.

Educate yourself

One of the best ways to reduce money anxiety in the long term is through increasing your knowledge. Until relatively recently, finding accessible and helpful content on managing your money was challenging. Thankfully, in recent years have seen a rise in resources aimed at breaking the stigma and helping women in particular to feel more comfortable with all things finance. If you don’t know where to start, take a look online at organisations such as The Money Advice Service who offer free, impartial advice and resources.